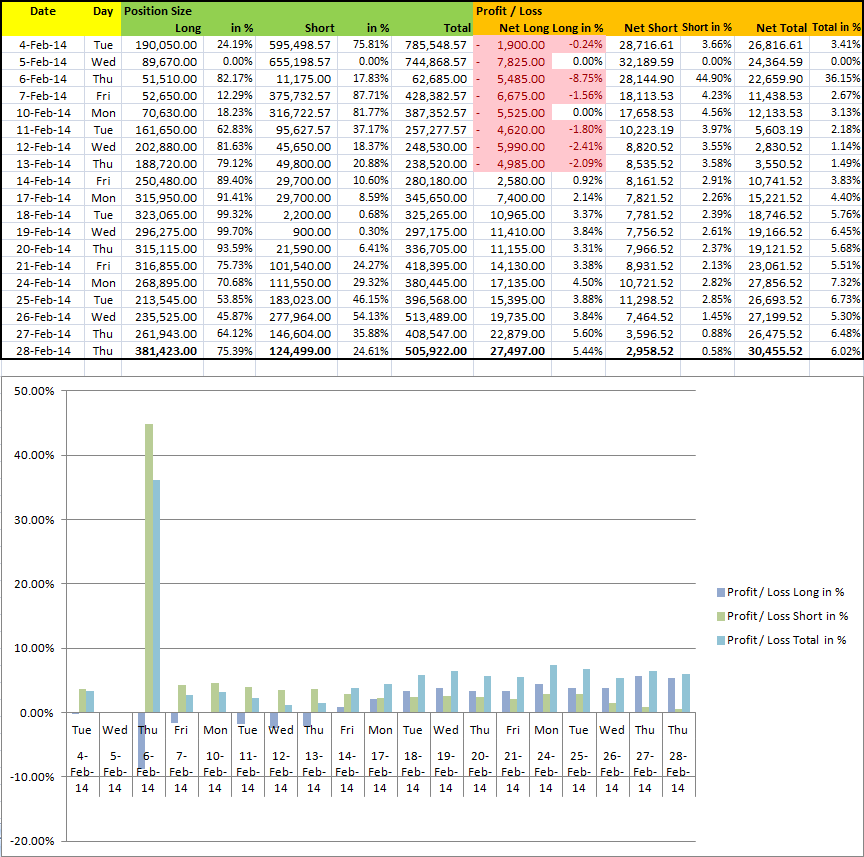

It’s the first complete trading month since the setup of this stock portfolio.

The up portion of the portfolio experienced a steak of losses in the beginning of the month because of two reasons. First, the stock market plunged since the last trading date before the Chinese New Year holidays. Second, a simple yet very powerful position exit strategy was added to close the position regardless of wins or losses, in addition to the 5% stop loss strategy. The technical indicator used to exit the position is Stephen Bigalow’s T-line. Long positions are closed when price breaks below the T-line whereas short positions are offset when price crosses over the T-line from below.

There’s net increase in the portfolio value as of 28-Feb-2014. Some stocks have performed brilliantly with a percentage increase over 100%. Long position still contributed most of the total profit.

Happy trading!